- Wealth Builders

- Posts

- Invest in the Market with Downside Protection

Invest in the Market with Downside Protection

Are Structured Notes for me?

Most clients of mine want the upside of the stock market but are weary of the negatives associated with it. Historically speaking, there has never been a 15 year period in history where the market returns were negative.

However, there have been shorter periods of market decline.

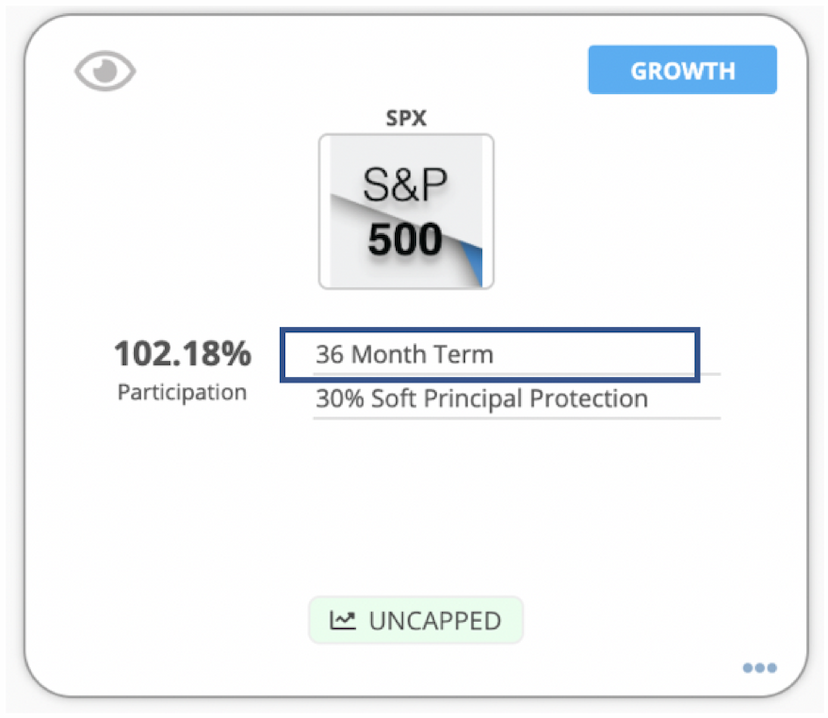

Structured Notes are products that financial institutions create to help investors achieve the growth of the markets but create some downside protection in the short term. These are customizable products for your timeline, investment amount and risk tolerance.

Below are some details that further explain Structured Notes

Four Components of Structured Products

Term

Similar to a bond, every Structured Note has a specific maturity date. Typical terms range from two to five years, but the range can extend from one month to 10 years.

Reference asset

A Structured Note's performance is linked to the price return of a reference asset. The most common reference assets include stock indices, individual stocks, and ETFs. The reference asset can also include interest rates, commodities, and other securities that have a liquid derivatives market.

Payoff

Payoffs generally come in two forms: Growth or Income. In positive return scenarios, Growth Notes pay a return multiple tied to the price appreciation of the reference asset at maturity. The growth multiplier can be less than or greater than one and is typically dependent on the degree of protection. Income Notes may pay a fixed rate at a predetermined frequency, similar to a bond yield. This income stream may or may not be contingent upon the performance of the reference asset.

Protection

Protection is the primary reason investors are drawn to Structured Notes, as most come with a level of downside investment protection. This means that, at maturity, if the reference asset is above the protection level, investors see their full principal returned. With a buffer, or “hard protection,” a Structured Note absorbs a portion of the loss if the underlying reference asset is below the protection level. With a barrier, or “soft protection,” once the protection level is breached at maturity, the investor is fully exposed to the price loss of the underlying reference asset.

We’re here to inspire, educate, and help you make informed decisions that lead to financial freedom.

Feel free to visit our website at: https://gowealthbuilders.com/

Weekly videos posted on our YouTube Channel: Wealth Builders YouTube

Stay tuned and let’s build wealth—together.

Warm regards,

Brawley Adams and The Wealth Building Team